Setup: Commencement and Preparation

STP Commencement Checklist

Businesses will have various processes to check and adjust to get ready for the commencement of STP. The impact on your business may reach further than the payroll department. For the latest developments and advice keep in touch with the ATO and HR3 through social media.

- Follow HR3 on LinkedIn, Facebook, Twitter, Google+ and YouTube. In addition, our website has a dedicated STP page for information.

- Follow the ATO on social media - the ATO is on Facebook, Twitter, LinkedIn and YouTube. If you don’t already, now is a good time to follow the ATO to keep across important changes.

- Review your payroll processes - HR and Finance may need to review processes that relate to on/off boarding employees, paying their wages and reporting/paying PAYG and superannuation

- Ensure you are paying your employees correctly.

- Check if you are calculating your employees’ super entitlements correctly.

- Check if you are addressing overpayments correctly.

- Is your employee information accurate, including names, addresses, date-of-birth records?

-

Check that any deductible Allowances are correctly allocated to an STP Allowance Type

- Check that any relevant ‘Workplace Giving’ or ‘Fee’ deductions are correctly specified

- Ask your employees to sign up to myGov - now is a good time to talk to your employees about the benefits of having a myGov account. To set up a myGov account you can follow this link: https://my.gov.au/LoginServices/main/login?execution=e1s1

- Apply for more time if you need it:

- If you feel you will need more time beyond HR3’s deferred start date, you will need to apply for your own deferral.

- Make sure you follow the ATO guidelines and provide all the evidence required. The ATO will only provide deferrals for extenuating circumstances.

- Update your HR3 payroll software when it is ready, and start reporting to the ATO:

-

HR3 and the ATO will help and support you through your first year of reporting.

- It's okay if you make a mistake – you will be able to make corrections.

-

The first year is a transition and the ATO have indicated that penalties will generally not apply.

Preparing Company Details

As the ATO has provided HR3 with a deferral to 1st April 2019, all HR3 payroll customers (with 20 employees or more) are granted an automatic deferral to this date. This means that HR3 customers must start reporting during the FY19 financial year, rather than on the first pay after 1 July 2018. We expect that HR3 customers will commence STP reporting from December 2018.

We have received ATO Operational Framework approval and are currently performing the ATO Conformance testing. The final step is the ATO Product Verification Testing (PVT) and the timeline for this is determined by the ATO approval process. The current timeline between the three parties (HR3, SunSuper and the ATO) indicates approval should be January 2019.

There will be several steps involved in transitioning to STP reporting and these are outlined next. Specific training sessions on transitioning to STP will also be made available and these will commence closer to the December 2018 commencement date.

Activate STP

First you need to activate your HR3 payroll license for STP via the HR3 STP portal.

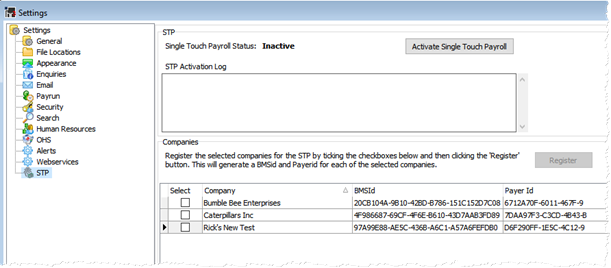

- Go to Tools | System Preferences | STP. The following screen will display;

- The screen will indicate the current status of STP in your database – either ‘Inactive’ or ‘Activated’. If it is currently showing ‘Activated’ then you can skip this section and move onto Company STP Registration. If it is currently ‘Inactive’ then click the ‘Activate Single Touch Payroll’ button and HR3 will attempt to activate your license on the STP portal.

- A log of the activation process is displayed.

- If successful, the Single Touch Payroll Status will change to ‘Activated’ and you can proceed to Company STP Registration.

- If the log shows an activation error, please contact the HR3 support desk and report the error code displayed. They will be able to assist you to complete the process successfully.

Company STP registration

Once the database has been activated for STP, you need to register all the companies that you will be processing under STP. As HR3 clients can have multiple companies in a single database, we have provided a bulk enrolment function to speed the registration process. This process generates the two ID’s for each of the selected companies that are required for STP processing. If you have already completed this process then the current BMS ID’s and Payer ID’s will be shown.

- BMS ID – This stands for Business Management System ID and the ATO uses this ID to uniquely identify each ABN entity and the payroll system (ie the BMS) that is being used.

- Payer ID – this is used to identify the ABN entity within the Sunsuper BEAM API.

In the same screen as above, the bottom section of the screen will show your current companies. To select the companies that you wish to enrol in the STP process, you need to select the checkboxes next to the company name as follows;

- You can either select the individual companies one at a time, or if you wish to enrol all the listed companies then you can right-click and choose Check All. You can also untick all companies by right-click and then choosing Uncheck All.

- Once you have selected all the companies you wish to register for STP, click the Register button.

- HR3 will generate a Payroll Payer ID and BMS ID for each of the selected companies.

Overriding a BMS ID

There are certain circumstances where it may be necessary to override the BMS ID that HR3 generates with another BMS ID. One such example is where a company transitions from one STP enabled payroll system (1st BMS ID) to another STP enabled payroll system (2nd BMS ID), part way through a financial year. If the company has already lodged STP PayEvents using the 1st BMS ID and wishes to load YTD balances into the new payroll system, then they cannot use a different BMS ID or the YTD values will be reported twice.

The scenarios around transitioning between STP enabled payroll systems are quite complex and therefore you will need to contact the HR3 payroll support team for advice on your options. To avoid the possibility of incorrectly overriding a BMS ID, this process requires an unlock key to be entered which only the support team can provide.

To override the BMS ID;

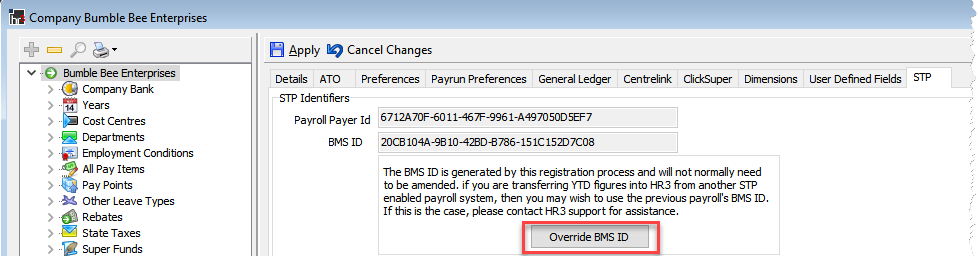

- Go to Navigator – Company – Maintain Company Details – STP. The following screen is displayed.

- Click on Override BMS ID. If you have contacted the HR3 support desk and they have confirmed that a BMS ID override is warranted, then you will be given the required Day Pass code.

- The BMS ID field will activated and you will be able to enter the BMS ID that you require.

Entering Bureau provider details

If you use HR3 payroll to provide payroll processing services on behalf of the listed companies then there are additional details that you will need to complete. In terms of STP, the ATO deems you to be an ‘Intermediary’ acting on behalf of your client companies.

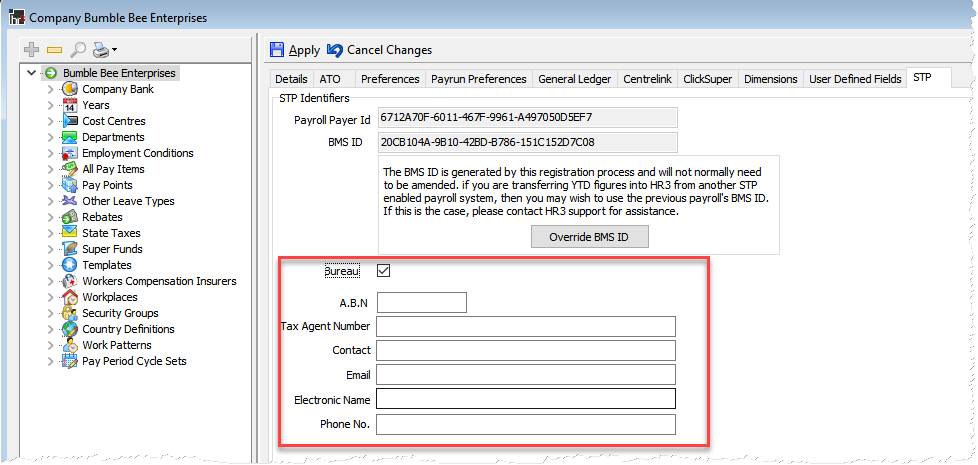

- To enter your bureau details go to Navigator - Maintain Company Details – STP and the following screen is displayed.

- Tick the Bureau checkbox and the extra Bureau fields will be displayed

- Enter the bureau provider ABN

- Enter the bureau provider’s Tax Agent Number

- Enter the Contact name

- Enter the contact’s Email address

- You can skip Electronic Name

- Enter the contact’s Phone No. and click Apply to save your changes for this company.

NOTE: If you have a large number of companies that you need to enter the same bureau details for, please contact the HR3 support staff as they can assist you to update the bureau details in bulk rather than doing them one company at a time.

Allowances

Where an employer pays deductible allowances to their employees, these need to be categorised into one of the following STP Allowance Types.

- travel

- car

- meals

- laundry

- transport

- other.

IMPORTANT: only deductible allowances need to be categorised. These are typically allowances that an employee can claim separately in their tax returns. HR3 support staff cannot assist you in determining if an allowance is deductible. See the ATO’s website for further details on deductible allowances.

If you have ascertained that you have deductible allowances then proceed to step 1 below otherwise you can skip to the Deductions step.

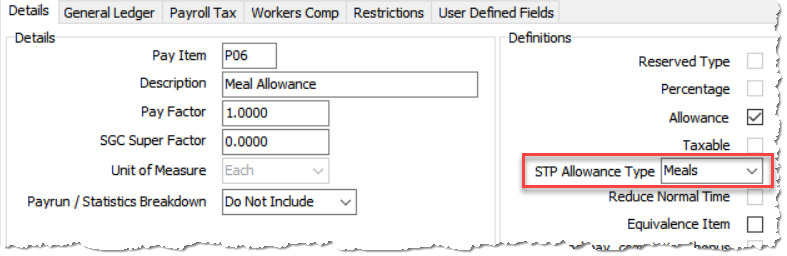

- Allocate any deductible allowances to an “STP Allowance Type” by going to Pay Items | Payment Pay Items screen and then choosing the appropriate entry from the list called STP Allowance Type

Note: the new STP Allowance Type field is only active if the Allowance checkbox is ticked.

Deductions

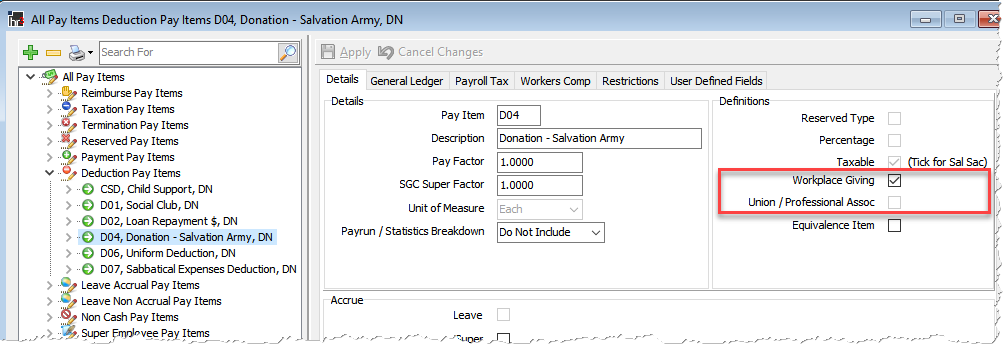

STP has specific rules relating to the reporting of ‘Fees’ and ‘Workplace Giving’. If you have any existing deductions for either ‘Union/ Professional Assoc’ or ‘Workplace Giving’, then these will already be allocated correctly.

- To check if you have the appropriate checkbox options selected or to manually allocate a new deduction; Go to the Pay Items | Deductions screen and tick the relevant checkbox option - Workplace Giving or Union / Professional Assoc.

Preparing Employee Details

Ensure all of your employee information is up to date including names, addresses, date-of-birth, tax file numbers, termination dates (where applicable), employment declaration etc.

HR3 recommend that you run a number of reports during the set-up phase. This is to ensure that all the necessary information is included in your STP submission, and it is in the correct format. In this way, you may minimise the chance of errors occurring, particularly when you first start using the Single Touch Payroll process.

With Data Explorer

Users of HR3 payroll can run the relevant reports using Data Explorer.

| Data Explorer Report Name: | To ensure these are correct/provided: |

|---|---|

| Employee Details | TFN, Birth Date, Hired Date |

| Employee Address/Phone | All employees: |

|

Must have a preferred address Overseas employees: Address must have Street, Suburb, Country Phone numbers: must not contain any characters other than [()] space and 0 through 9 |

Paylite Users

As Paylite users do not have Data Explorer, the following reports can be run instead:

- Employee Taxation Details - (TFN)

- Employee Address and Phone - (Preferred address and phone number valid characters)

- Employee Base Details - (Birth date and Hired date)